For anyone who owns a car in Malaysia, they’ll definitely be familiar with road tax and car insurance policies before they even take their first drive of their new car!

Car insurance or motor insurance in Malaysia typically comes in various degrees of coverage to protect your car. Today, most drivers in Malaysia purchase a comprehensive policy. However, although it sounds like it covers every single part of the car, it actually isn’t the case. Most car or motor insurance leaves out windscreen insurance!

In this article, we’ll explore more about what is windscreen insurance coverage, what you should do if your windscreen is damaged during an accident and how to claim from an Etiqa windscreen panel!

What Is Windscreen Insurance Coverage?

Windscreen insurance or coverage is a type of additional protection for your car’s windscreen. It is usually offered as an add-on to your car insurance policy, where you have to activate your car’s insurance to be able to purchase this windscreen insurance.

The coverage commonly provides protection, repair or direct replacement for:

- Front windscreen

- Back and rear windscreens

- All door windows and quarter glass

- Sunroof glass (original and not a modification sunroof)

What You Should Do If You Get A Cracked Windscreen During An Accident

- Stay calm, be polite and courteous. You should refrain from admitting liability or offering any settlement or payment.

- Note down the following items:

- The personal particulars of the driver involved in the road accident

- The name of the insurer of the other vehicle/s

- The brand, model and registration numbers of the other vehicle/s involved in the road accident

- The registration number of tow trucks (if any)

- Snap photos and note down the extent of the damage to the vehicles involved.

- Immediately call your insurance roadside assistance service( 1 300 88 1007)

- Make a Police Report of the incident within 24 hours. You are required by law to lodge a police report as soon as practicable.

- Cooperate with the investigators and appointed loss adjuster to undertake an independent assessment of the repairs recommended by the panel workshop

What documents do you need for an Etiqa windscreen panel claim?

- A copy of Police Report (applicable for Motor accident) (mandatory)

- Zoomed view of the damage or breakage BEFORE repair/replacement of the windscreen with vehicle pillars (mandatory)

- Full view photo AFTER repair/replacement of windscreen & Vehicle’s Plate No. with date imprinted (mandatory)

- Zoomed view of the damage or breakage AFTER repair/replacement of the windscreen with vehicle pillars (mandatory)

- Original Receipt/ Bill/Invoice with company’s letter head (mandatory)

- Photo of Chassis Number with date imprinted. (mandatory)

- A copy of Police Report – if caused by malicious damage (mandatory)

- Payment Instruction order/Authorization letter – if pay to non-panel workshop (provide workshop’s Maybank Account No.) (mandatory)

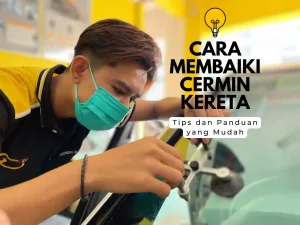

Looking for windscreen replacement? Choose the provider you can trust – choose Windscreen2U

Windscreen2U is Malaysia’s leading automotive safety glass repair and replacement company with one of the first door-to-door windscreen replacement service in Malaysia!

We are an Etiqa windscreen panel and can help you with an Etiqa Malaysia windscreen claim.

With a fleet of mobile technicians, we aim to provide a superior service with value, safety, and satisfaction at the heart of our business regardless if you have windscreen insurance coverage or not.

Contact us today at +6012-226 3776, 1700-81-1022 or email windscreen2u@gmail.com for windscreen repair nearby you in KL at your convenience!